The Philosophy of Subtraction

Craigslist, value creation, and decarbonization

Sup y’all —

Happy 2020 and welcome to the Ideaspace. It’s great to be back with you. Everybody good? I’ve got some new tour dates up on my site, including a couple of talks in SF in a few weeks. Bay Area readers, I hope to see you there :)

Value creation and subtraction

Ten years ago today, a venture capitalist named Andrew Parker wrote a blog post about Craigslist. In it, he highlighted all the different businesses that the listings site spawned using a version of this image:

As the image illustrates, most of the services that Craigslist offered eventually turned into competing businesses. While others built out the more capital-intensive and upscale versions of these categories, Craigslist served an enormous addressable market (basically all human-to-human exchanges) with a virtually identical, incredibly limited product.

In the years since this image appeared, I've seen its meaning evolve. Instead of an illustration of Craigslist’s breadth, it’s seen as an example of what not to do as an entrepreneur. "Look at all the value that Craigslist failed to capture!" To those eyes, the image is an example of missed opportunity. To mine, it represents the creation of it.

The fact that Craigslist built such a resilient business without trying to keep all value for itself is more net-value positive than trying to own the field. Craigslist would have deviated from its core purpose (which is offering the same limited functionality for essentially everything), likely dooming it in the long run. And even if they did somehow succeed and own these markets, that would’ve ultimately been worse for the world.

One of the better articulations I’ve seen of the Craigslist mindset comes from the blockchain world. The Ethereum Foundation’s Philosophy of Subtraction lays it out like this:

The left-hand column is what’s normal today. Business schools teaching digging moats around value instead of how to help it grow and spread. The right-hand column is closer to a Craigslist approach. Few companies have tried harder to matter less while being used by so many people as Craigslist.

A world where more organizations adopt a philosophy of subtraction would be one where companies create and distribute value rather than seeking to capture it. This wouldn’t mean the missions or impact are any smaller. The subtraction mindset shifts success from Me to Us, making collaboration and differentiation legitimate strategies for success instead of impediments to it.

Project Wren

For the past year I’ve been advising the team behind a carbon offsetting subscription service called Project Wren.

The service is simple: assess your lifestyle with a carbon calculator by answering a few questions, then select the offsetting project to support with a monthly donation based on your footprint. My monthly Wren bill is $40 that goes to planting and protecting trees in Kenya.

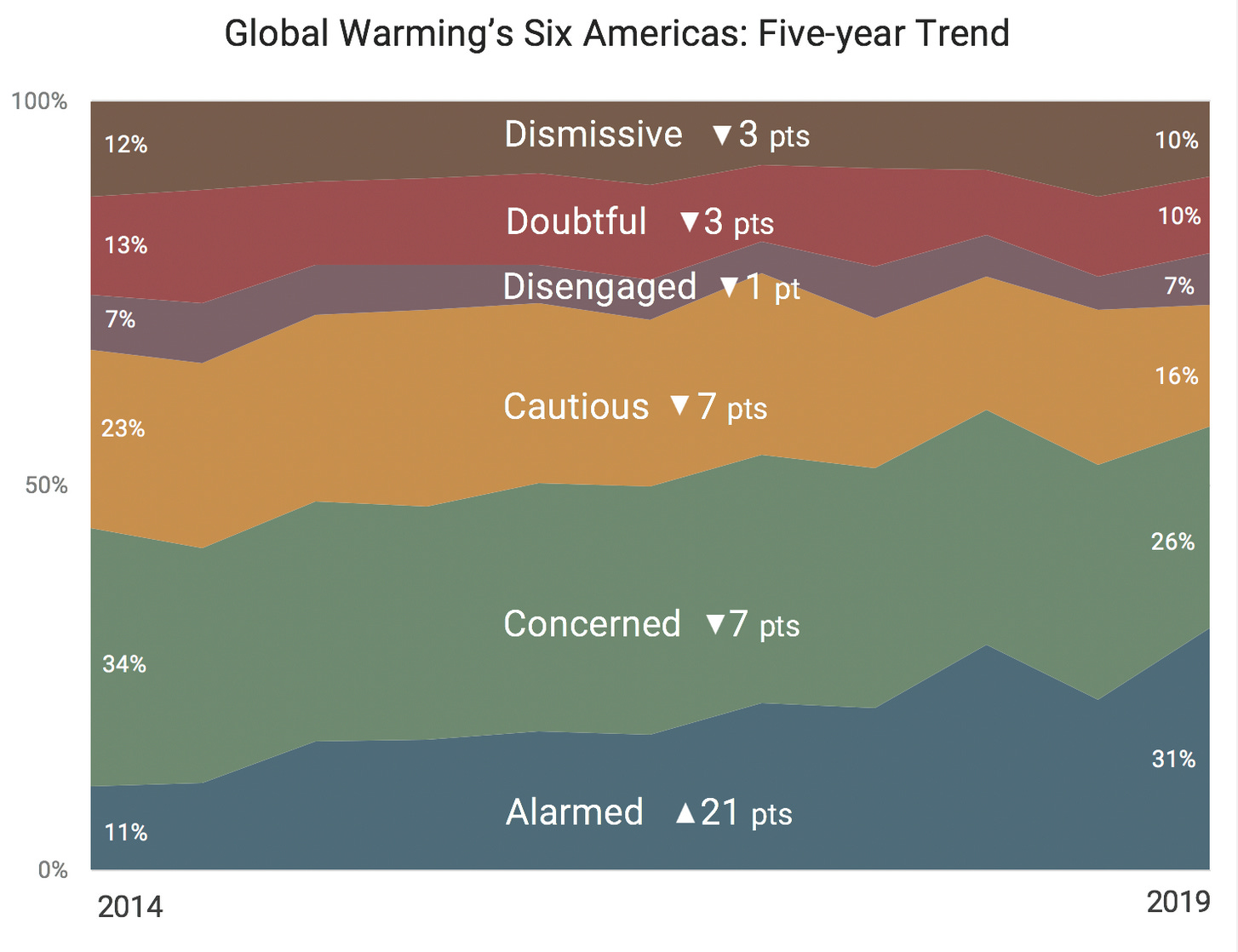

A few years ago I wouldn’t have signed up for something like Wren. I thought that by believing in and having a general awareness of climate change I was somehow “doing my part” despite functionally doing basically nothing. That changed for me this past year, as it did for a lot of people. In 2019, a majority of Americans (57%) categorized themselves as “alarmed” or “concerned” about the climate for the first time:

The new normal we’re facing is reordering how we think about the world. And yet for all the rhetorical garment-rending and teeth-gnashing, little if any meaningful action has been taken to do something about it.

A recent UN report found that changes needed to decarbonize would cost $300 billion. If that funding came from shifting money intended for carbon extraction into new sources of energy, it’s possible to see a path where we avoid the scariest scenarios. The money to do this exists. The will to use it, however, does not. Investments into renewable energy increased by only 1% last year. Conversations like the recent one I had with the outdoors CEO who didn’t want to invest money into climate change are a perfect example of where we are: cash-rich and values-cheap.

So close and yet so far.

In an alternate universe where the domestic politics in the US and elsewhere were more stable, this would be the moment when nations would come together to launch a collaborative process of rapid transformation based on a foundation of renewable energy. Alas, these are not our times. Not yet, anyway.

Offsetting isn’t the solution, but it is part of one. I think of offsetting as a form of self-taxation. I’m converting financial capital into ecological capital on a continuous basis while increasing my awareness of and responsibility for my behavior at the same time. As a new norm, self-taxation is a form of economic volunteerism that could drive larger behavioral changes, too. (This post by Rhys Lindmark is great on this.)

Wren is part of a growing wave of activity (Climate Neutral is doing something similar for companies) focused on decarbonization. Last week Wren announced its Series A funding with Union Square Ventures, Paul Graham, Michelle You, Jeff Atwood, and myself among its investors. Check out Wren for yourself here, and consider offsetting your carbon!

Etc

If you’re looking for other decarbonization strategies on an individual level, this Twitter thread is a good discussion and this Project Drawdown list is a great overall resource.

Microsoft’s declaration to go carbon negative by 2030 could set a positive new standard. This is where the competitiveness of the market can help as one company seeks to out-virtue the next — but only in a world where we create accountability around decarbonization, too. How do we know whether these announcements are “real”? Here’s an explainer.

The politics of climate action are a major TBD, as this excellent Foreign Policy piece by Adam Tooze details. He reminds us that it’s China’s orientation towards decarbonization that might matter most of all.

Non-violent groups Greenpeace and XR were listed as groups to watch on a UK counter-terrorism list.

My three words to describe nature in the “Proust Nature Questionnaire”: “Shhhwwwwwwww (wind through the trees), tckltckltckltckltckl (leaves on the ground), grglgrglgrglgrgl (water falling from a rocky cave).”

I enjoyed being interviewed on the Big Think podcast.

Just finished HBO’s The Watchmen — incredible.

Here’s a new mix of music:

Tracklist:

01 The Voidz, “Did My Best”

02 The Ethiopians, “Train to Skaville”

03 The Isley Brothers, “Footsteps in the Dark, Pts 1 & 2”

04 J Dilla, “So Far to Go”

05 Miles Davis Quintet, “It Never Entered My Mind”

06 Karen Dalton, “One May Morning”

07 John Fahey, “Sligo River Blues”

08 Hailu Mergia, “Tche Below”

09 Earl Sweatshirt, “El Toro Combo Meal”

10 Smog, “I Could Drive Forever”

11 Fruit Bats, “Flamingo”

I’m tweeting again (for now). You can follow me on Twitter here or on Instagram here.

Peace and love everybody,

Yancey

The Ideaspace is an email sent when inspiration strikes by Yancey Strickler. If you signed up in error or no longer wish to receive it, you can unsubscribe below. To share with a friend, forward this email. My book This Could Be Our Future: A Manifesto for a More Generous World is available now and can be ordered here. If you like the book please tell a friend about it or review/rate it on Amazon/Goodreads xoxoxo